The Best Strategy To Use For Final Expense In Toccoa Ga

Wiki Article

Automobile Insurance In Toccoa Ga - Questions

Table of ContentsSome Known Incorrect Statements About Medicare Medicaid In Toccoa Ga Indicators on Medicare Medicaid In Toccoa Ga You Need To KnowThe Basic Principles Of Commercial Insurance In Toccoa Ga The Ultimate Guide To Medicare Medicaid In Toccoa Ga

A financial advisor can additionally help you decide just how finest to accomplish objectives like conserving for your child's university education or repaying your debt. Although monetary consultants are not as skilled in tax legislation as an accounting professional could be, they can use some advice in the tax obligation planning procedure.Some economic advisors use estate planning services to their customers. It's important for economic consultants to remain up to date with the market, economic problems and advisory best methods.

To market investment items, advisors should pass the pertinent Financial Industry Regulatory Authority-administered exams such as the SIE or Series 6 tests to get their qualification. Advisors that wish to offer annuities or various other insurance coverage items should have a state insurance coverage permit in the state in which they intend to sell them.

Things about Affordable Care Act Aca In Toccoa Ga

As an example, allow's say you have $5 million in properties to manage. You hire an expert that charges you 0. 50% of AUM each year to benefit you. This suggests that the advisor will certainly get $25,000 a year in charges for managing your investments. Since of the typical charge framework, numerous experts will not deal with customers that have under $1 million in assets to be handled.Capitalists with smaller portfolios may seek an economic advisor that bills a hourly cost as opposed to a portion of AUM. Per hour costs for advisors normally run in between $200 and $400 an hour. The even more facility your economic scenario is, the even more time your expert will certainly have to dedicate to handling your possessions, making it a lot more pricey.

Advisors are experienced professionals who can help you develop a prepare for financial success and execute it. You may likewise think about connecting to a consultant if your personal financial situations have just recently become much more challenging. This might indicate purchasing a home, getting married, having youngsters or obtaining a big inheritance.

The Ultimate Guide To Home Owners Insurance In Toccoa Ga

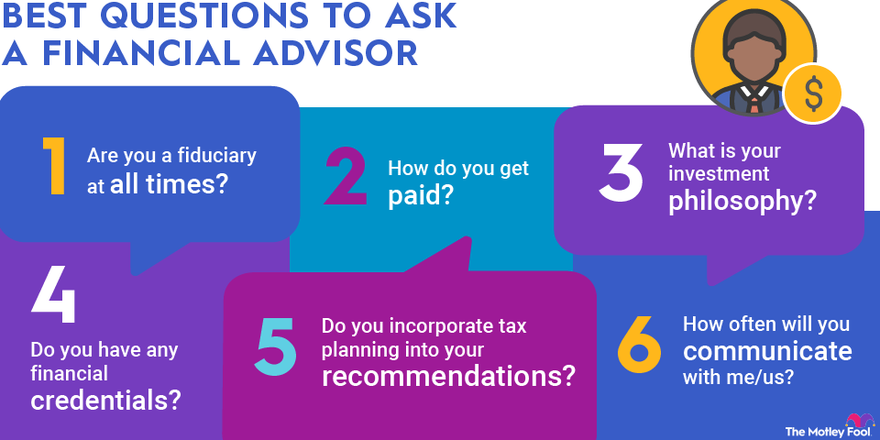

Before you satisfy with the consultant for a preliminary appointment, consider what services are essential to you. Older adults may need assistance with retired life preparation, while more youthful adults (Health Insurance in Toccoa, GA) might be seeking the most effective way to invest an inheritance or starting a business. You'll want to choose a consultant that has experience with the services you want.How much time have you been suggesting? What organization were you in before you entered into monetary advising? Who makes up your normal client base? Can you give me with names of several of your customers so I can discuss your solutions with them? Will I be collaborating with you directly or with an associate expert? You may also desire to consider some sample financial strategies from the consultant.

If all the examples you're offered coincide or similar, it might be a sign that this expert does not correctly customize their recommendations for each customer. There are 3 primary kinds of monetary advising experts: Licensed Monetary Coordinator experts, Chartered Financial Experts and Personal Financial Specialists - https://www.slideshare.net/jimthomas30577. The Qualified Financial Coordinator expert (CFP professional) accreditation indicates that an advisor has satisfied a specialist and moral standard set by the CFP Board

Some Known Details About Life Insurance In Toccoa Ga

When choosing a financial expert, take into consideration somebody with a professional credential like a CFP or CFA - https://www.easel.ly/infographic/85cidm. You could additionally take into consideration an advisor who has experience in the services that are crucial to youThese consultants are typically riddled with conflicts of interest they're more salespeople than consultants. That's why it's important that you have an expert that functions only in your benefit. If you're trying to find an expert that can truly offer genuine value to you, it is very important to research a number of potential alternatives, not merely select the initial name that markets to you.

Presently, several advisors have to act in your "finest passion," but what that involves can be almost unenforceable, other than in the most outright cases. You'll need navigate here to locate a real fiduciary.

"They need to confirm it to you by showing they have taken serious ongoing training in retirement tax and estate planning," he says. "You ought to not invest with any advisor who doesn't invest in their education.

Report this wiki page